Residential Donations | Habitat for Humanity of Greater Sacramento

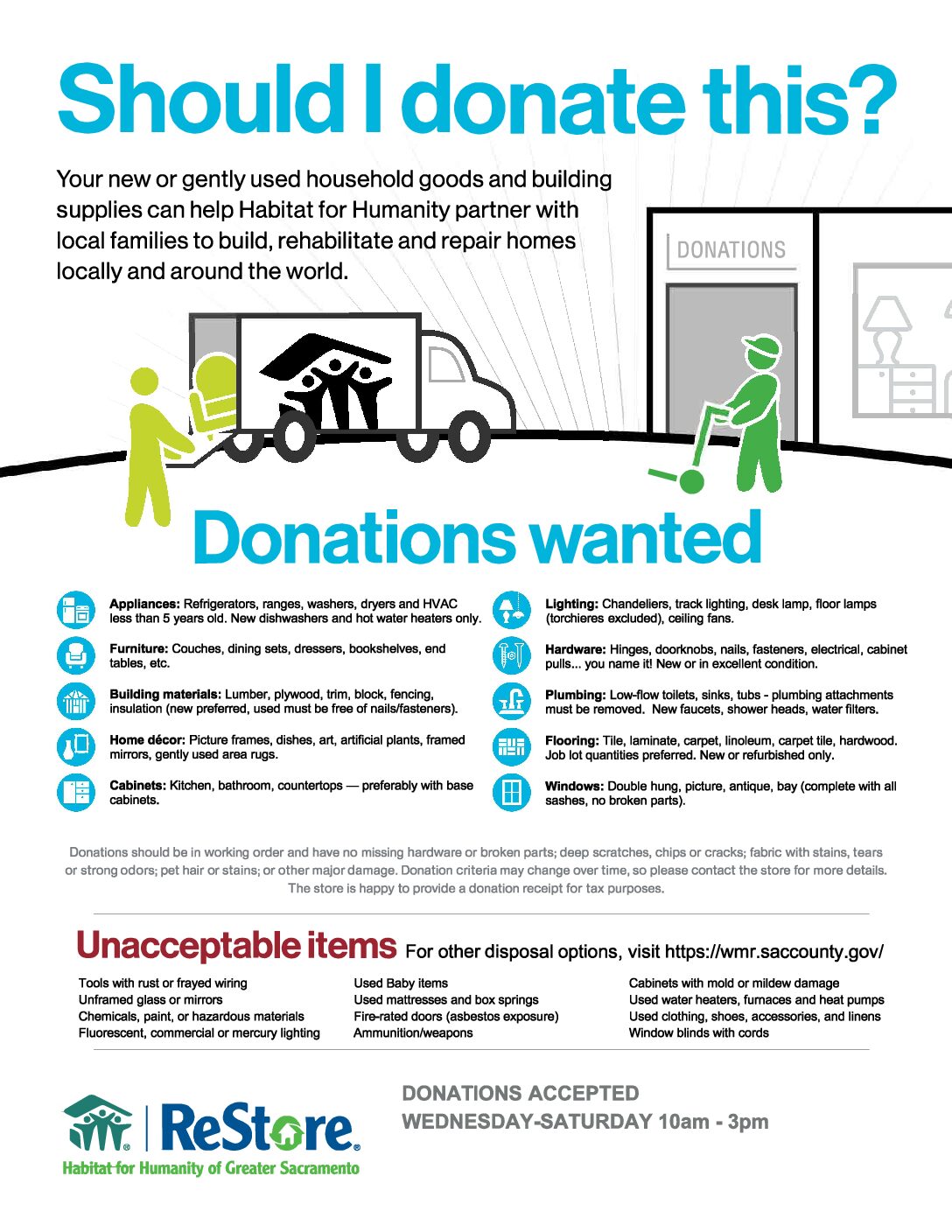

The ReStore is always looking for donations of new and gently used materials to add to our inventory and help fuel our mission of building homes for low-income families. If you have items from the below list of acceptable donations that you are looking to keep out of the landfill, we will gladly receive them at our ReStore in exchange for a tax-deductible receipt!

If the ReStore cannot accept your donation please click here for resources that may be able to receive your donation.

The Habitat for Humanity of Greater Sacramento ReStore no longer requires appointments to accept residential donations. Please ensure that your donation meets the above criteria. We accept residential donations Wednesday through Saturday, 10 am – 3 pm.

If you would like to schedule a donation pickup through our partner organization resupply, please click the link below.

Tax-Deductible

Donating goods to the ReStore could qualify you for a tax deduction. Please see the resources below, in order to find out if your donation is tax-deductible.

Please be advised, if a tax deduction on a gift is to be taken, the Internal Revenue Service has regulations for filing tax-deductible contributions valued at $250 or more. Please see the following information to help determine whether or not your donation is tax-deductible. If the value of the donation is greater than $5,000, an independent appraisal is required and Habitat staff is required to sign the IRS Form 8283 acknowledging receipt of the gift. To be acceptable to the IRS, the appraisal must be made no more than 60 days before the date of the contribution and before the due date of the tax return.

The Donor is asked to present the appraisal and completed IRS Form 8283 to Habitat at the time of the gift. The Form will be returned to the Donor with proper signature. For additional information see Determining the Value of Donated Property, Charitable Contributions, and a listing of appraisers.